Yes, I believe everyone needs a financial advisor.

If you are asking “Do I need a financial advisor?”…

“Do I need a financial advisor” is one of those questions we ask, but never trust the answer. People say we don’t need a financial advisor because we just need to spend less. That’s all we do as financial advisors is yell at clients for spending too much, right? That was sarcastic by the way.

Of course, they also say we can read a book about finance and learn everything we need to know. Which book should you choose? There are thousands! Some are good, while others only brag about investments that made the author rich…notice they didn’t say how much they lost before those great investments.

Maybe our own egos make the same arguments? With today’s technology, we have all of the knowledge of the world in the palm of our hand, so we can manage our finances ourselves, right? Sure, you can, but should you?

Why do I need a financial advisor?

Dave Ramsey and others may not even have a job if everyone had a financial advisor who helped them stay away from those inevitable “mistakes” BEFORE we made them. These growing pains are part of life. We learn a hammer hurts when we accidentally hit our finger instead of the nail and we learn living beyond our means is dangerous by experiencing it. Imagine an advisor who stands beside you and helps you build a life, not just one who waits for you to fall or just capitalizes on your success.

The value promise I offer to clients is peace of mind, not higher returns or lower fees. There is no way anyone can make these guarantees. Maybe that’s why so many have bad experiences with financial advisors? Yes, stocks have proven throughout history that they can provide the best return on our money over time. However, in order to receive that higher return, you have to be willing to accept risk.

Managing your risk tolerance is where an investment plan becomes so important. It helps clients ride the ups and downs of investing instead of panicking when their accounts decrease. Those market downturns may be the best time to contribute to your account. It may also be the worst time. Consistent contributions may be the best way to help you reach your goal by utilizing dollar-cost averaging. An investment plan is something a financial advisor can do. In fact, ALL financial advisors SHOULD be helping you with an investment plan. Contrary to what some believe, investing is not a get rich quick scheme, nor is it a sucker’s game. Too often, bad experiences come from investors who don’t have the steady hand of a financial advisor guiding them through the entire process.

Yes, you can invest in your retirement yourself, but you can also raise your own food. Isn’t it a lot easier to just go to the grocery store? Imagine all the work that goes from raising a cow to cooking a steak. Now that’s an investment of time! Take a moment to think about your day. How often do you think about your retirement account? Does it even cross your mind? Would you have time to work on it anyway? Will Social Security and your 401(k) be enough to cover retirement? How much will you need?

Your career is the only time where you can accumulate the funds needed for retirement. Basically, you only get one chance to get this right. Some say a financial advisor is too expensive, but when the stakes are this high, I would argue you can’t afford not to have a professional help plan for your future!

What kind of financial advisor do I need?

Let’s talk about how much a financial advisor costs. Every professional service has a fee. Nobody wants to work for free, right? Unfortunately, the financial services industry has marketed itself as unaffordable to many people. Stop believing this myth! We’ve all seen the commercials saying, “If you have $500,000 or more call us.” It sounds like the person with $5,000 doesn’t matter, which is so sad to me because we all need help sometimes.

That might be why it took me so long to get a job in this industry. I was more interested in helping a person build wealth than I was in just getting a wealthy person to leave their current advisor. Note that the wealthy person already had an advisor, so to answer your question, YES you likely need a financial advisor if you want to grow. But wait – aren’t financial services only for the wealthy? No! By offering a variety of services, financial advisors can help people at all levels of wealth.

My point in mentioning all this is that once you determine that the answer to “do I need a financial advisor” is yes, there is one more important step. Before you do anything else, you should think about what kind of financial advisor you need. We aren’t all the same; we offer different services models, fee structures, etc., and we serve different clientele. As with any professional relationship, the fit between the client and the service provider is one of the most important determinants of success.

When do I need to hire a financial advisor?

One of my core beliefs is that you need a financial advisor BEFORE accumulating wealth. Does an architect design a house after it is built? No! The house is built by following a very specific blueprint. Without the architect putting a plan on paper the house cannot be built.

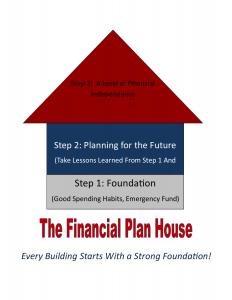

As your financial advisor, my job is to be the architect for your retirement nest egg. On my desk is an image I call the Financial Planning House. It shows how I believe we can create wealth over time and put us on a path where, together, we develop a plan that gives you the best chance to reach your reasonable goals.

- STEP ONE – This is the foundation of the house. The foundation is the most important part. Without a strong foundation, your home cannot withstand the storms of life. This is even a Biblical point where Jesus speaks about building a house on a rock versus building a house on sand. Needless to say, the house on sand falls because it has a weak foundation! Check out Matthew 7:24-27 for the whole story. Yes, I’m taking this out of context and I’ll gladly talk with you about the entire message of Jesus, but this part makes my point.

From the financial advisor point of view, your foundation is where your emergency fund is created through good spending habits. A good foundation prepares you for having more money. People with a good foundation don’t spend money just because it’s in the account. They realize money is a tool and nothing more. The spend, save, and invest with a purpose. We live in a world where many adults are not taught any financial management skills. How often do we hear about celebrities and athletes going broke after making huge amounts of money? This is all because they lacked a strong foundation in financial management.

To make matters worse, there are many technological advances allowing people to pay bills with a click of a button and automatic drafts. These are a great convenience, but they prevent us from learning financial management. I fear these advances actually encourage people to avoid understanding money. Out of sight out of mind, right? Yes, money can be scary, but it’s also a great blessing when used properly. I offer a foundation planning service which helps the client address these issues.

- STEP TWO – This is when we start planning for your future. What about today, right? Shouldn’t we enjoy life because we never know what can happen? A person with a strong foundation doesn’t panic about the things that come up today. They are prepared to weather the storm, remember? Step two occurs in what financial advisors call the accumulation phase. During this phase we must find the balance of enjoying today and preparing for tomorrow.

What if not buying your dream car or home fresh out of college allowed you to stop working 5 years earlier? It could happen. We have to weigh these options every day. Sometimes we’ll be disappointed, but disappointment now could pay huge dividends in the future. Again, in our lifetime we will only have a certain amount of money available. You only get one shot at this. If you don’t prepare for the time when you can no longer work, you are going to be forced to rely on the resources of family members or even the Government…nobody wants that!

I’ve been asked if funding college for children should come before retirement. It’s easy to assume taking care of the children first is best, but not in this situation. There are scholarships and student loans for college. These opportunities are not available for funding your retirement. Your financial security relies on accumulated resources…and your financial advisor helping you create (and stick to) a plan. Your children may not like it, so remind them that sacrificing now prevents you from having to move in with them in the future. I bet they’ll download that FAFSA application immediately!

- STEP THREE – After we have spent years building a

comfortable house, with a strong foundation, it’s time to close in our roof. This is when we retire, which is a word I hate because it sounds like you’re waiting to die! I prefer it to be called financial independence. That’s the dream we are working for people! How often do you compare your life to others? A person who has financial independence doesn’t need to do this. They’re able to take that trip, buy their grandchildren a puppy, or remodel their home. How did they do it? By following a plan and putting the work in BEFORE they reached this level.

comfortable house, with a strong foundation, it’s time to close in our roof. This is when we retire, which is a word I hate because it sounds like you’re waiting to die! I prefer it to be called financial independence. That’s the dream we are working for people! How often do you compare your life to others? A person who has financial independence doesn’t need to do this. They’re able to take that trip, buy their grandchildren a puppy, or remodel their home. How did they do it? By following a plan and putting the work in BEFORE they reached this level.

Final Thoughts on the question of “Do I need a financial advisor”!

Congratulations if you made it this far! I’m exhausted! My marketing consultant taught me that my blogs need to be longer, so they will rank higher on search results. This is opposite from what I’ve been led to believe because I’ve always heard we humans have short attention spans. Of course, the idea that we can only pay attention for like 30 seconds has always been insulting to me. We’re better than that! If not, nobody should be driving a car! How dangerous is that!?! But I digress…

Our world is extremely busy and our time is more precious than ever, so doesn’t it make sense to have a financial advisor? Wouldn’t you rather watch your children play in mud puddles instead of reading stock reports trying to build the portfolio you need to reach your goals? Why not let a professional free up that time for you?

If I can bring you some peace of mind, then I believe I’m doing my job as your financial advisor. This world is stressful enough, let me help take some of the burden off of you. I can’t promise we’ll reach all of your goals or you’ll be able to buy your own private island, but I can reassure you that you’re not alone on this journey. However, it’s up to you to take the first step. Yes, I believe you need a financial advisor. We all do! We need to plan for success if we’re going to have any chance to be successful.

Contact me if you would like to learn more about my process and how I get to know people that I work with.