Can you take financial planning steps without money? “I need money to plan with before meeting with you,” is the most popular rejection I hear when I talk to people about financial planning. Granted, I am biased because I believe everyone can benefit from some financial planning, but I think that is a lame excuse….

-

June 24th, 2024

Financial Planning Without Money

-

April 27th, 2023

Top Three Excuses People Use to Avoid Financial Planning

There are many excuses why people avoid financial planning. Some are very creative and way out there, but most are reasonable. A financial planner’s job is to help the client work around their excuses and prepare for their future. As much as I hate to admit it, part of a financial planner’s job includes selling. …

-

January 22nd, 2023

Focus in Financial Planning

Focus, in financial planning and in life, is one of those underrated characteristics that need attention. We live in an age where we can instantly access almost all of the world’s knowledge, yet our attention span is the shortest it has ever been. I experience this myself because I cannot stream shows or movies on…

-

June 28th, 2022

Recession, Recession, Recession

How can we survive a recession? Did you know there is a chance of a recession looming on the horizon? If not, do you live under a rock? Depending on which channel you watch, the recession could be short or it could be the end of the world. This is why when we invest, we…

-

April 28th, 2022

Financial Planning: Asking for Help

Humility – Asking for help with financial management. There are millions of websites telling you about financial management and it will be difficult for me to pull the audience away from those sites. I have a degree in finance and still look at those articles myself, so I don’t fault you at all for going…

-

January 21st, 2022

Tithing is an Investment

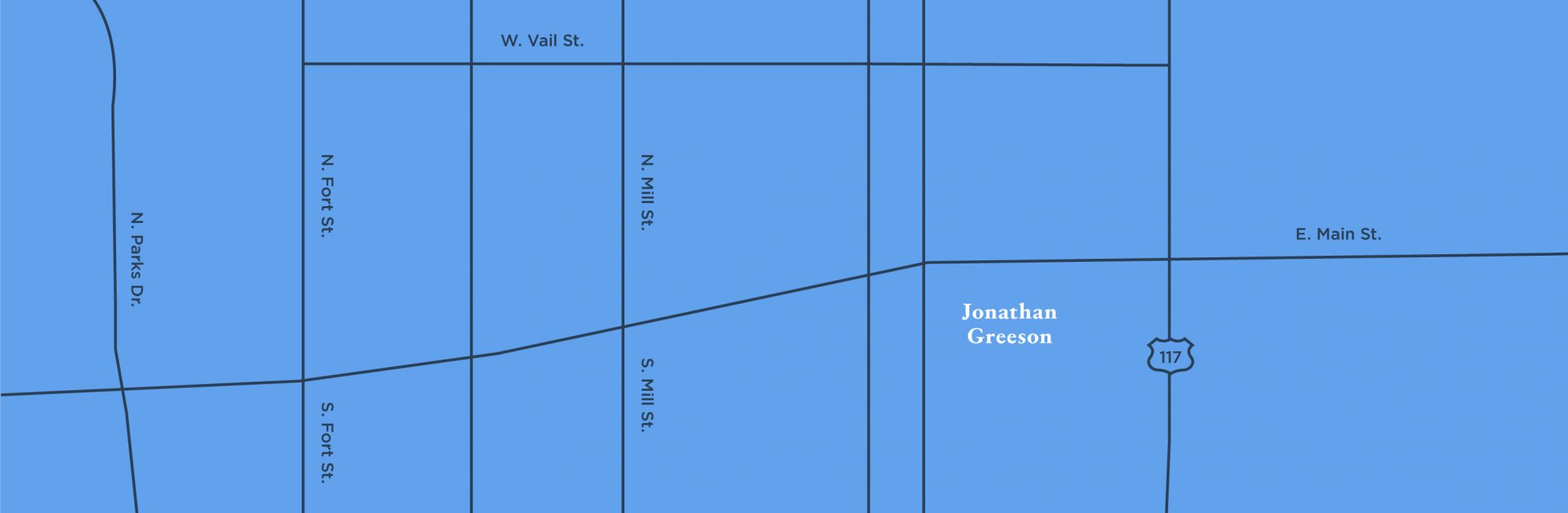

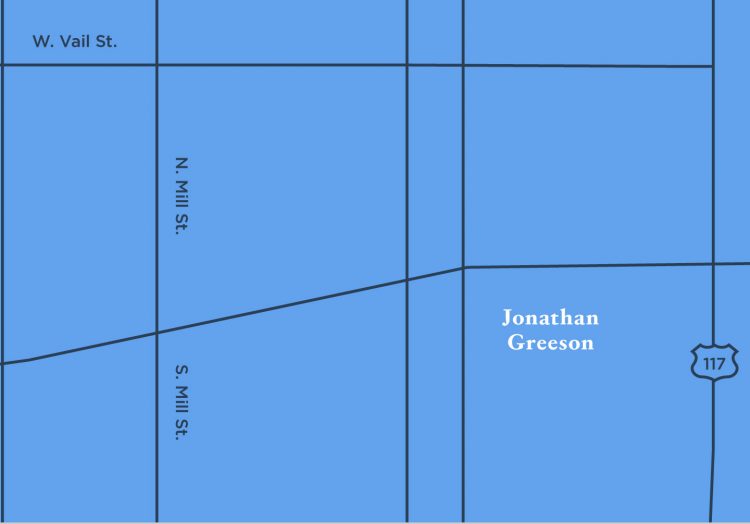

Financial Planning in Pikeville, North Carolina Pikeville, North Carolina is a small town with about 700 residents. Pikeville is in Wayne County, which has approximately 120,000 residents. Being a financial planner in Pikeville brings an interesting challenge because it’s not so much about having more money as it is about maximizing the money we have. …

-

November 24th, 2021

The Three Questions We All Ask Ourselves

Financial advisors can talk about money all day, but we really want to know about you; the client. It’s hard to help you reach your clearly defined, reasonable goals if we don’t take the time to get to know you. While financial planning is a fairly new industry, the concept is as old as mankind….

-

September 23rd, 2021

Why Does Your Credit Score Matter?

Why does your credit score matter? Simply, it can help create opportunities. We can sit around complaining about how our jobs should pay us more for our entire lives. The odds are nothing will change, so we must take steps to help ourselves. Also, many of us work at small businesses where our employer cannot…

-

February 20th, 2021

Why I Love Being a Financial Advisor in Goldsboro

It can be hard finding a financial advisor in Goldsboro and the surrounding towns in Wayne County, but I love our community. Advisors make most of their income from managing a client’s investments, so if there aren’t assets to manage, it can be difficult to make a profit. It becomes a numbers game, which leads…

-

November 24th, 2020

How much should I have in an Emergency Fund during COVID-19?

How much should I have in an emergency fund during COVID-19? The normal rule of thumb for how much to have in an emergency fund is enough to cover three to six months of expenses. Let’s be honest, the COVID-19 Pandemic dislocated that rule of thumb. If you had six months of expenses and lost…