Is Financial Advising a Scam? Don’t Fall for It!

Financial Advisors know the look we receive when we tell someone what we do for a living. It usually involves an eye roll as if they’re just waiting for your sales pitch. The question is if they really hate salespeople that much or do they believe financial advisors are con artists?

I recently read Don’t Fall for It: A Short History of Financial Scams, by Ben Carlson. It is a wonderful book and a fairly quick and enjoyable read. I already had an interest in protecting others against scams, especially after attending webinars for identifying cases of elder abuse. Unfortunately, elder abuse is a huge issue in the financial services industry. Yes, there are definitely bad people who use the title of financial advisor to take advantage of the elderly, but you may be surprised to know that it is often the person’s own family members trying to get their hands on grandma and grandpa’s money.

book and a fairly quick and enjoyable read. I already had an interest in protecting others against scams, especially after attending webinars for identifying cases of elder abuse. Unfortunately, elder abuse is a huge issue in the financial services industry. Yes, there are definitely bad people who use the title of financial advisor to take advantage of the elderly, but you may be surprised to know that it is often the person’s own family members trying to get their hands on grandma and grandpa’s money.

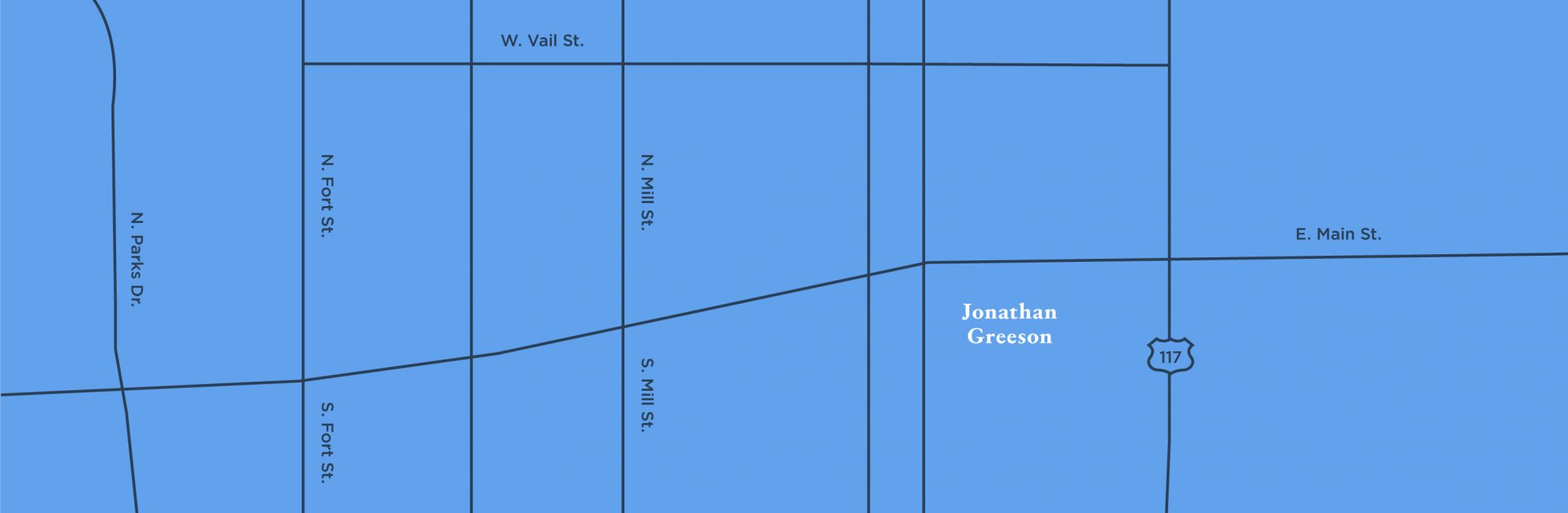

This subject is so important that I wrote this month’s newspaper article on it as well. It is below.

Trouble is Calling

There are many people out there trying to take advantage of our senior citizens. I’m not sure who sells the phone numbers to these people, but they seem to be alerted when people retire or enroll in Medicare. We have to be careful, so here are a few tips to help you and your loved ones avoid scams.

First, never give your Social Security number over the phone. The Social Security office already has your number. They do not need you to give them the number to confirm your identity. You may need to give the last four digits to confirm a pre-scheduled conference call, but you would receive an official letter in the mail from the Social Security office before any meetings. They will never just randomly call you.

Furthermore, when a “customer service representative” calls you, make sure you use the products or services they are calling about. People claiming to be at Apple or Amazon call my dad about his account that he doesn’t have. Obviously, these calls are a scam. If you receive a call like this, check with your bank to make sure there are no strange charges on your account. You can also go to the company website and review your account. Do not give the people on the phone your personal information.

Unfortunately, there are evil people in the world and technology allows them easy access. It always helps to be a little skeptical. If you have any doubt, ask someone for help!

What stuck out to me while reading Carlson’s book was that it provided yet another example that evil has always existed in our world. Too often we say things like “this isn’t how it used to be” or “what is wrong with people these days.” Trust me, I can sound like an angry old man with the best of them and have said those exact words myself. However, there is overwhelming evidence that people haven’t really changed, it is our access to bad things that has changed.

Scams in the past compared to current scams.

Of course, there were scams during the old days just like today. When the population caught on to the scam, the con artist would be run out of town (Or even killed depending on the mood of the citizens!). Then they would travel to a new state or country where they would start their con all over again.

In the past, ignorance was bliss. Let’s say you lived in the 1800’s on a nice little homestead raising livestock with your family. When you needed money, you would take a cow to the market in the closest town, which was probably 20 miles away. Mom and Dad would be gone a couple of days and return without the cow, but with new provisions for survival. And no, Jack, they did not trade the cow in for magic beans! Their priority was keeping the family alive, so they couldn’t care less about a con artist taking advantage of people three towns over.

Fast forward to today and life is a lot easier for us and the con artist as well. Your next door neighbor could be running an online scam promising happiness to people for $10 and you would never know. When the con artist is close to getting caught, they can create a new online identity and start over. They would probably make a ton of money too because our instant gratification society is all about a quick fix!

Fast forward to today and life is a lot easier for us and the con artist as well. Your next door neighbor could be running an online scam promising happiness to people for $10 and you would never know. When the con artist is close to getting caught, they can create a new online identity and start over. They would probably make a ton of money too because our instant gratification society is all about a quick fix!

Today, when scams are exposed, the story is all over the news, which makes us start to question everything. Being vigilant is great and a little skepticism never hurts, but we cannot be paranoid about every new product or service. It is vital that we maintain our discipline here because living without any trust in mankind is no way to live.

Is Financial Advising a Scam? The answer depends a lot on perspective.

Yes, there are bad people in the financial services industry, just like every other industry. Watch Law & Order or Criminal Minds often enough and you’ll start to think every person is “out to get you.” I only mention those shows because they’re my mom’s favorites and picking on her is a hobby (Love you Mom!). However, I do believe this type of show, as well as the news, help us lean to the negative side of a situation first instead of toward the possibilities and hope of building a better future.

Unfortunately, many people can call themselves “financial advisors” and that is why I believe the financial services industry is not trusted or even liked by many people. I don’t think we’re as hated as dentists, but we’re close. At least with a dentist, you know what you’re going to get with a visit. If you visit a financial advisor, you may get stuck with an insurance pitch or who knows what else.

financial services industry is not trusted or even liked by many people. I don’t think we’re as hated as dentists, but we’re close. At least with a dentist, you know what you’re going to get with a visit. If you visit a financial advisor, you may get stuck with an insurance pitch or who knows what else.

I can understand the frustration of a person needing help. They are already uncomfortable and perhaps embarrassed by their financial situation. When they finally get the courage to seek financial advice, the so-called advisor just tries to sell them life insurance. Yes, life insurance may be a piece of the puzzle, but the client needs more of a solution.

When an advisor is only interested in getting a commission, I don’t blame a client for feeling ripped off. You better believe they’re going to tell their neighbor too, which gives birth to a rumor that hurts all of us in the industry. A bad experience with a financial advisor does not mean the industry is a scam. It means you need to shop around for a financial advisor that fits your needs!

Let’s Be Clear – Low Returns or Loss Does Not Equal a Scam.

Human nature forces us to complain more about loss than we brag about gains. That’s why they say the bad feelings we have from losing hurt worse than the good feelings we gain from a win. Perhaps we think we’re entitled to the win and we only lost because of some unfair force? I don’t know. One thing I know for certain is that the stock market is NOT fair. It may be “fair” from an economics point of view, but it can be a complete jerk to a client who invested their life savings in the hope of a better future.

We all know that investments contain risks, including the risk of losing the original amount invested, and that past performance does not guarantee future results. Licensed professionals who work with investments have those words constantly drilled in our heads. Even with that knowledge, investors still search everywhere for the next “hot tip” that will make us rich. That strategy may have worked years ago, but with the access we all have now, everyone else already knows the tip when you do.

and that past performance does not guarantee future results. Licensed professionals who work with investments have those words constantly drilled in our heads. Even with that knowledge, investors still search everywhere for the next “hot tip” that will make us rich. That strategy may have worked years ago, but with the access we all have now, everyone else already knows the tip when you do.

You may make some money as the investment goes up, but the odds are that you have already missed the opportunity. Then you buy late, the price goes down, you panic and sell. This is the complete opposite of the investor’s mantra, “Buy low and sell high.” Yes, you lost money in the market, but that doesn’t mean you were necessarily the victim of a scam. Sure, your financial advisor will receive the brunt of your frustration and may even lose you as a client, but that doesn’t mean they are a con artist.

Honestly, I wouldn’t let you make that investment in the first place. No fiduciary should. Investing for a quick return is very similar to gambling. If that’s what you want, then buy a lottery ticket. If you bring your life savings to me, it will be invested with a purpose. We may still lose, but we’ll definitely have a long term plan!

Is financial advising a scam? Absolutely not!

Yes, there are bad people in the world. Many people will continue to be sold the “next best thing” by unscrupulous financial advisors. It’s sad and I hate to see it. However, a few bad apples shouldn’t muddy your view of the entire industry.

Financial advising is a highly-regulated industry. I’m not a fan of all of the paperwork, but it’s there to protect the client. I love the job and I cannot believe that something I’ve dedicated most of my life to learning about is a scam.

In order to protect yourself when choosing your financial advisor there are a few things you can do before committing to work with them:

- Find their website and see what services they offer. Many “advisors” offer different services that you may not even need at this point in your life.

- Check if they have letters behind their name. The size of the firm is not necessarily as important the experience of your advisor. Normally, letters are earned through much testing and an experience requirement. For example, I am a CERTIFIED FINANCIAL PLANNER™ and it took a lot of work to earn that title.

- Use the resources available to research your advisor. FINRA, the SEC, and the CFP® Board all have search tools where you can look financial advisors up by name. These tools allow you to make sure your financial advisor is registered and has stayed out of trouble.

When all else fails, trust your gut. If the advisor makes promises that are too good to be true, they probably are. Don’t fall for it! Find the advisor who will be honest with you through the good and bad times, who will help you develop and follow a plan, and who will try to make you as comfortable as possible on your financial journey.

Did I mention I’m accepting new clients? Email me!