Inflation is nothing new. We have all heard our elders say things like, “In my day I could buy a loaf of bread for a nickel.” Nickels and other monetary units are still the same as they were then, but the purchasing power has declined.

In essence, this is what inflation means. When we have spikes in inflation, like we’re currently experiencing, I view it as something being out of balance. Normally, economic issues can be drilled down to supply and demand.

In essence, this is what inflation means. When we have spikes in inflation, like we’re currently experiencing, I view it as something being out of balance. Normally, economic issues can be drilled down to supply and demand.

If everything is still basically a supply and demand equation, then a theory can be developed placing the power to fight inflation in the hands of the most powerful resource in the world – the consumer. That’s exactly what I did. Here are what I believe to be three ways we can fight inflation from home.

We can fight inflation from home by investing in our future.

First, we must invest in our future. I cannot stress this enough. To paraphrase the adage, “If you fail to plan for retirement, then you plan to fail in retirement.” We can safely assume inflation will be around in the future, so we’ll need more funds to maintain our desired standard of living. Even with proper planning, we may still need a part time job to supplement our lifestyle during retirement. That’s just the reality of the world in which we live today.

Fortunately for us, technology has allowed jobs to change, so there is less need for the heavy lifting that require a strong, young employee. In the past, retirement was a necessity because our bodies naturally deteriorate over time. Now, retirement is more of an option instead of a requirement. As long as an employee can efficiently do their job, then they can keep working.

The question is will you be prepared to be able to make the retirement decision? You’ll need enough resources, so that working can be a choice instead of a necessity. Yes, retirement planning starts with saving, but your money cannot fight inflation sitting in a bank account. Don’t kid yourselves, your money is absolutely at war with inflation and, as with all wars, there will be casualties.

The question is will you be prepared to be able to make the retirement decision? You’ll need enough resources, so that working can be a choice instead of a necessity. Yes, retirement planning starts with saving, but your money cannot fight inflation sitting in a bank account. Don’t kid yourselves, your money is absolutely at war with inflation and, as with all wars, there will be casualties.

Sure, investing has risks. You can lose your money. However, having all of your money in a savings account is basically giving your purchasing power a slow, painful death. Yes, it seems safe and it is for the short term, but I don’t think our neighborhood banks will ever consistently pay us enough interest to keep pace with inflation.

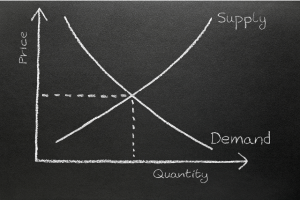

Remember what I said about supply and demand?

If banks make money by earning interest when they loan money, then obviously they can’t pay us as much interest as they charge on the loans. If a bank gave 7% on a savings account, they may have to charge 10% on a mortgage to cover their expenses. Their competition down the street gives basically no interest on the savings account, so they are able to offer mortgages at 4%.

The lower interest rate is going to get the mortgage customer’s business. This is supply and demand. It doesn’t always benefit us on both sides as savers and customers, but it’s normally somewhere working in our economy.

Please understand, I am not in favor of anyone putting every penny they have in risky investments, but I am in favor of investing being a part of your overall plan because it is the first step in fighting inflation from home.

We can fight inflation from home with self-discipline.

The next way to fight inflation from home is through self-discipline. We have all noticed the increase in prices of consumer goods. Which do you think is more likely, your boss giving you a raise or prices dropping? Remember, bosses have bills to pay too and forcing them to give you a raise may lead to inferior products made from cheap materials or it could even cost your co-worker their job. There is always a give and take in the financial balance.

Yes, human beings are naturally a little selfish and we lean toward looking after ourselves first, but nobody really wants to be the reason why a colleague is fired. Furthermore, when we beg our boss for a raise or even ask the government to step in, we’re giving up our control in the situation. One way we keep control and, I believe, a way to fight inflation is through consumer spending.

A major reason why the shelves have been so empty during the pandemic is because of something called Just In Time Manufacturing. It’s more expensive for companies to have warehouses full of products waiting to be purchased, so they produce them on an as needed basis. Tons of research has been done by companies allowing them to provide the products needed by the consumer without having to store excess inventory. This makes their financial statements look better and can make their stock improve.

Of course, all of the research in the world can’t accurately predict a pandemic. No, we cannot do much to change the prices of food, gas, and our other necessities. Hopefully, the Government and Federal Reserve can help us with that, but until then we can stop spending so much.

Yes, the world we live in is expensive and it’s so convenient! I don’t think there has ever been a time where our self-control is more important than now. Consumer spending is a major driver of our economy, so if we slow our spending, then that may bring the supply and demand equation back into balance. It won’t be easy and, honestly, it may not even work, but at least it’s something to try.

where our self-control is more important than now. Consumer spending is a major driver of our economy, so if we slow our spending, then that may bring the supply and demand equation back into balance. It won’t be easy and, honestly, it may not even work, but at least it’s something to try.

If we stop spending on unnecessary things, then inventories should rise. When inventories (supply) rise then prices should decrease as supply and demand return to an equilibrium for the specific products. By spending less, we also increase our savings rate and that money can be invested in your future as you continue to fight against inflation.

Recently, I was speaking to a friend about COVID. They wished it would just go away and I said it helps me to think of it as a war. I read a lot about World War II and the civilians that survived also had to endure the hardships of the war. They only focused on survival and found a great appreciation for life. There’s a reason why these people are referred to as our “Greatest Generation.” If those people could survive hiding from murderers and rummaging through garbage for food, then I can endure the limited supply issues and other inconveniences while we fight against a pandemic and other events around the world.

No, I’m not telling you how to live or how to spend your money. My job is to help you find a balance between enjoying today and preparing for tomorrow. We all have different priorities when it comes to spending, but I think everyone can spend less.

For example, maybe you can wait a little while before putting a television in each room. Sometimes we forget how truly blessed we are. With the small sacrifice of spending less, I believe we can help fight inflation from home and start building a better future.

We can fight inflation from home by not blaming others.

Finally, we can fight inflation from home by not blaming others. Yes, the decisions made by the Federal Reserve and our Government do impact inflation, but our complaining about it doesn’t do anything. When we complain, we become frustrated and angry, which leads to impulse spending as we try to “buy happiness.” Don’t believe me? Go grocery shopping while you’re hungry and tell me your mental state doesn’t impact your spending.

Finally, we can fight inflation from home by not blaming others. Yes, the decisions made by the Federal Reserve and our Government do impact inflation, but our complaining about it doesn’t do anything. When we complain, we become frustrated and angry, which leads to impulse spending as we try to “buy happiness.” Don’t believe me? Go grocery shopping while you’re hungry and tell me your mental state doesn’t impact your spending.

This goes back to the consumer spending argument. If we continue to pay these extreme prices for unnecessary items, the demand stays high and it throws the equilibrium price out of balance. Again, it boils down to supply and demand. We want to lower demand, allow supply to rise, and prices to level off.

The Federal Reserve and the Government are going to do what they do. Personally, I’m always looking at the long term for my clients, so I would accept a falling market in the short term as the Fed raises rates to fight inflation. I would also like the Government to leave taxes alone and add a second standard deduction for technology spending. Life requires internet and cell phones and it’s a major expense for low to middle income families, so I think that would be a nice way to put money back in our wallet.

What I hate most as a financial planner is to be stuck in limbo as policies are debated.

Waiting costs my clients time and that’s their greatest asset! I focus my practice on younger clients that aren’t interesting enough for the big firms (meaning they don’t have enough money). I want to build the 20-year relationship even though it may not be profitable at first because it allows the client and my practice to grow together. Time is the biggest piece of that puzzle, so when policymakers waste time, it really ticks me off!

Conclusion: Three Ways to Fight Inflation from Home.

Inflation cannot be shut on and off like a light switch. It will be a process and we will probably experience some bumps along the way. That is what is so interesting about economics. We always learn new things. Yes, there are formulas we follow, but many assume a perfect scenario.

Unfortunately, life never gives us those perfectly planned out situations. Even if our personal life worked out exactly as planned, we would still have the desire to help others. That’s great, but it would add variables to even the best plans. There will always be something that comes up and in our lives we have to endure, adapt, and make adjustments.

The past two years and the present are giving us a great opportunity to make adjustments. We can either accept inflation or we can fight it. If one person refuses to pay extreme prices, nobody cares. However, if 300 million stop unnecessary spending, the world may get the message.

I believe we can fight inflation by investing in our future, having more discipline with our spending, and by complaining less about our policymakers. If you’re ready to accept the challenge, I’ll be glad to be a part of your financial journey. Together, we can build a plan where we can find the balance between enjoying today and preparing for tomorrow.

I believe we can fight inflation by investing in our future, having more discipline with our spending, and by complaining less about our policymakers. If you’re ready to accept the challenge, I’ll be glad to be a part of your financial journey. Together, we can build a plan where we can find the balance between enjoying today and preparing for tomorrow.

Email me and let’s get to work!