How can we survive a recession?

Did you know there is a chance of a recession looming on the horizon? If not, do you live under a rock? Depending on which channel you watch, the recession could be short or it could be the end of the world.  This is why when we invest, we have to try and silence all of the noise. It’s like when you Google the symptoms of a head cold and the results make you start thinking you have an alien flesh-eating virus!

This is why when we invest, we have to try and silence all of the noise. It’s like when you Google the symptoms of a head cold and the results make you start thinking you have an alien flesh-eating virus!

I guess it’s a good thing that everyone at least agrees a recession is a possibility. Always the optimist, I think we will experience a short recession. Of course, recessions are rarely a pleasant experience, but I do believe we’ll survive. We may even come out of the recession stronger than ever. After all, that is what happens when we overcome adversity, right?

We survive a recession by understanding the definition.

When facing a problem, we must first identify and define the problem. Investopedia is a great resource for learning financial terms. They define a recession as:

A recession is a macroeconomic term that refers to a significant decline in general economic activity in a designated region. It had been typically recognized as two consecutive quarters of economic decline, as reflected by GDP in conjunction with monthly indicators such as a rise in unemployment. However, the National Bureau of Economic Research (NBER), which officially declares recessions, says the two consecutive quarters of decline in real GDP are not how it is defined anymore. The NBER defines a recession as a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.

In the grand scheme of things that doesn’t sound too bad does it? It is serious and I don’t mean to make light of a tough situation, but that doesn’t sound like the end of the world to me. Of course, it can be devastating if you are one of those that loses your job.

I’ve experienced a parent losing their job and it’s not easy. I lost my first job as well when it was restructured. Actually, it was moved upstairs, so it was no longer accessible to me. I was ready to move on anyway, but it was still a little disheartening.

We survive a recession by understanding job security.

Politicians love to talk about employment and blame each other, but the reality is none of us really have job security in good or bad economic times. Honestly, I don’t really blame employers for that phenomenon either. Sure, there are bad apples out there who should not be employers, but I think a majority are trying their best to balance having a successful business and creating jobs in their communities.

I’ve had home health aides leave because another provider paid ten cents more per hour. That equals $2.00 more per week or $104 a year. When I see someone who “cares about helping people” leave for an extra $2.00 per week, it makes me sympathize with employers.

$2.00 more per week or $104 a year. When I see someone who “cares about helping people” leave for an extra $2.00 per week, it makes me sympathize with employers.

Politicians love to promote themselves as fighters for the American worker and attack employers because they want votes. However, they forget that it’s hard to manage a business when you don’t know if your employee will stay or leave. We have to remember that loyalty works both ways.

Don’t worry, I am a friend of the employee as well.

On the other side, employees are different from past generations. Our careers rarely involve staying with the same company. We climb the ladder by moving to different positions in other companies. We absolutely should always try to better ourselves and we should be rewarded for bringing new ideas and innovations to companies.

Different jobs over our career help us become more well-rounded and marketable employees. This is a good thing as the economy changes because we learn the new skills needed. We don’t want to have another experience like in the textile industry as those jobs were outsourced and many employees didn’t yet have the skills needed for a career change.

True job security lies in us always learning new things and being prepared for a career change.

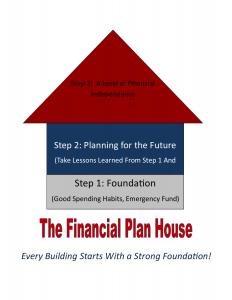

We can survive a recession with a financial plan.

One of the best ways to prepare for a career change or the loss of a job due to a recession is through financial planning. Yes, I believe financial planning can solve many problems! When we don’t have a plan, we are planning to fail.

I remember being shocked in my first college class because the teacher started talking about a Screw You Fund. Being from a rural, small town I was not used a teacher talking like that, so it definitely got my attention. We were being trained to be middle managers and he knew there would be times in our career where we faced difficult decisions, perhaps even some that we knew were wrong.

The Screw You Fund was a way to allow us to walk away from the job. When our personal ethics are being violated we could say, “Screw You” and leave the job.

Of course, this is basically your emergency fund.

Yes, it is designed for the emergencies that occur in life, hence the name, but it is so much more. I believe the emergency fund is the foundation of your financial life plan. Having the ability to cover six months of expenses gives you back some control in your life.

It’s great to love your job and place some of your identity in your career, but you should not be a slave to a paycheck. Yes, we need money to survive and jobs are the provider of that money. However, when you’re in a bad situation and feel like you have no other choice, then the job controls you.

It’s great to love your job and place some of your identity in your career, but you should not be a slave to a paycheck. Yes, we need money to survive and jobs are the provider of that money. However, when you’re in a bad situation and feel like you have no other choice, then the job controls you.

Of course, there’s a difference in having a tough, challenging day and living in a hell on earth. We cannot compromise our work ethic just because every day isn’t fun. Employers don’t like employees that jump from job to job either because it shows a lack of commitment.

Your emergency fund allows you to leave a bad situation while having some time to find the right job for you. Without it, you’re at the mercy of your employer.

Can our portfolios survive a recession?

This is the big question and I waited until the end for a specific reason. Financial planning is a combination of using our resources in the present and the future. I believe we need to make sure our present life is in some sort of order before working on the future. That’s why the emergency fund is so important.

Yes, you can invest in your future and build your emergency fund at the same time, but it still takes a plan. I think people have a bad experience investing because they aren’t in a position to handle a loss. The market is not a place for a get rich scheme or a last ditch effort to cover a bill.

The market is where we put our money, so that it can work for us and help accumulate the resources we need in the future.

It will go up and down over the years. Sometimes it’s actually good for it to go down because you can get more value for your monthly contribution. That’s why consistent investment on your part can be as important as what funds in which you choose to invest.

Furthermore, your time horizon always needs to be part of your investment decisions, but even more during a recession. The time horizon is the amount of time from when you start investing to when you need to start using the money. For example, a 25-year old who planned to retire at 65 would have a 40 year time horizon.

If you’re nearing retirement, then you’ll have a shorter time horizon, so you may need to make adjustments to your portfolio. Hopefully, your adviser already planned for this and you’re in lower risk anyway. For the younger person, a recession could be an opportunity where they can invest more and be glad they did 40 years from now.

Conclusion. Surviving a recession from home.

It’s easy to talk about portfolios and investments, but what really matters when surviving a recession is SURVIVING. You need to make sure there is food on the table and a roof over your head. Trust me, I understand.

I think we should prepare for a recession like we do a hurricane. We put together a survival kit with everything we’ll need to survive a few days without electricity and other basic conveniences we enjoy. Then we wait for the storm to hit, endure the damage, and recover.

The difference with a recession is that your survival kit is your emergency fund. Also, a recession can be much longer than the post-hurricane recovery.

The difference with a recession is that your survival kit is your emergency fund. Also, a recession can be much longer than the post-hurricane recovery.

We’re going to have to endure.

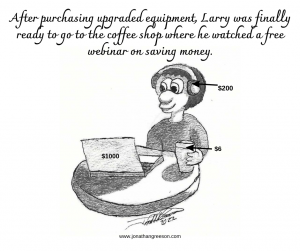

No, I’m not going to be like a politician and say you can’t drive or do whatever because that just makes you want to do it more. Our country was built by rebels, so it’s kind of in our nature to be a little rebellious. I do, however, think we can be a little more creative with our priority spending.

We are a consumer spending driven economy, so the consumer should have some control over the economy. If we want to lower inflation, then we can refuse to pay high prices. We don’t have to be constantly entertained every single day.

We can make that gas tank last a little longer by not waiting in line at a drive through or not driving 200 miles to spend an hour at the beach. A beach vacation is great, but it doesn’t have to be a daily routine. We can even stay home!

Dust off those board games, invite your friends over, attend free events at your church. Yes, those hatchet throwing places are cool, but that’s something you can do for free outside! Draw a target on an Amazon box, grab a pocket knife, and have fun. Stay safe though!

Sure, we spent two years cooped up in our homes because of COVID and I hated it as well, but I would rather stay home than be homeless. When we don’t prioritize our spending, that is exactly what can happen during a recession. We believe there will always be another job, but we should absolutely plan for a time when no job can be found.

Sure, we spent two years cooped up in our homes because of COVID and I hated it as well, but I would rather stay home than be homeless. When we don’t prioritize our spending, that is exactly what can happen during a recession. We believe there will always be another job, but we should absolutely plan for a time when no job can be found.

Is your financial situation prepared for a recession? It wouldn’t hurt to let me take a look. Send me an email and let’s get to work!