Focus, in financial planning and in life, is one of those underrated characteristics that need attention.

We live in an age where we can instantly access almost all of the world’s knowledge, yet our attention span is the shortest it has ever been. I experience this myself because I cannot stream shows or movies on my laptop without trying to do work.

One of the greatest lies we are told in our professional lives is we must learn the ability to multitask. We’re taught that multitasking means the ability to do two things at once. It may be possible, but your focus will suffer.

One of the greatest lies we are told in our professional lives is we must learn the ability to multitask. We’re taught that multitasking means the ability to do two things at once. It may be possible, but your focus will suffer.

When you lose focus, the quality of your work suffers as well. Don’t believe me? Try typing two documents at once. The cursor is only active in one document at a time. That’s how our focus should be.

Without Focus in financial planning, your plan has a better chance to fail.

When people ask what a financial planner is I tell them that I’m basically a coach. Sure, I manage investments, monitor cash flow, and help you get out of debt, but my main purpose is to keep you focused on your goals. I want to get you from where you are to where you want to be.

With so many distractions in today’s world it’s easy to see how we have trouble focusing on the future. Unfortunately, if we don’t plan for our future, we won’t be prepared when it comes. Sounds pretty obvious, right?

Focus in financial planning: But Jonathan, I can barely pay my current bills. How can I save for the future?

I realize we’re struggling as life has become more expensive, but we are also extremely blessed. We must never forget how fortunate we are to be alive at this time. Let’s look at an example.

You may have heard that people in underdeveloped countries live on the equivalent of two dollars a day. Yes, it gives us an interesting perspective, but I’ve found clients prefer to keep the example in America. As one person put it, “Well yeah, but life is so much more expensive here.” I think they are missing some of the point, but they aren’t wrong.

Imagine living prior to the industrial revolution in early America. Your parents gave you five acres of land on which you could build a cabin and grow some crops. It was a hard life, but you were in a better situation than other people during this time. Unfortunately, if your crops didn’t make it, the odds were that you would die before the next growing season.

Today, we can change careers for any reason, such as just wanting to try something new. Sure, we need jobs to earn the money needed to live, but for most of us, each day is not the life or death situations faced by people living in early America.

Focus in financial planning: On a side note…Oh look, I lost my focus too!

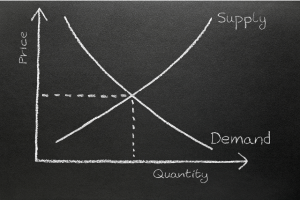

Fortunately, in a normal capitalist society, there is always money to be exchanged for goods and services. As long as you have desirable skills, someone should pay you for the work they need completed. Unfortunately, the downside is that there are normally more applicants than there are jobs.

Advocates of Modern Monetary Theory suggest a federal job guarantee, so people who are able to work can have a job and contribute to society. It is an intriguing idea and I would love to see how it would work. Unfortunately, even with a federal job guarantee, there will come a time when you are no longer able to work or you’ll wish you didn’t have to work.

can have a job and contribute to society. It is an intriguing idea and I would love to see how it would work. Unfortunately, even with a federal job guarantee, there will come a time when you are no longer able to work or you’ll wish you didn’t have to work.

That’s where financial planning comes into the picture. My job is to make sure you are prepared for that time. There are too many distractions for you to focus on your future alone. Let me coach you. I’ll stay locked in on your future goals, so you can focus on the rest of your life.

Focus in financial planning: Our mindset matters!

Recently, we celebrated the memory of Dr. Martin Luther King, Jr. I can’t imagine what he went through during his mission. We talk about his assassination, but remember what he had to endure before that. Through all of the hate, anger, and sadness he faced, he continued to preach messages of love and hope. He focused his mindset on the hope he had for the future of mankind instead of the struggles he faced each day.

There are many of his quotes that will live forever, but my favorite is:

“If you can’t fly then run, if you can’t run then walk, if you can’t walk then crawl, but whatever you do you have to keep moving forward.”

Yes, life is hard. Politicians are frustrating. There is evil in this world. When complaining about our situation keeps us from pursuing our goals, then we’re complaining too much! We have to start shifting our mindset toward hope for the future or we won’t be ready for it.

Goals help maintain your focus in financial planning.

The right mindset doesn’t matter when you have no direction. Without financial planning goals, we have no way to center our focus. Think about it. Lines on a highway keep us in our lane and headed toward our destination. Shouldn’t we have some guidelines for our money as well?

I enjoy baseball. A player can have all the talent in the world, but it takes a ton of focus to play the game. The slightest distraction can make the greatest professional player look like a child at his first practice.

I’ll never forget one of those moments at a North Carolina State University baseball game. The Wolfpack had a runner in scoring position with one of their best hitters at the plate. It was a perfect situation for NC State fans. After missing the first two pitches with terrible swings, I heard the coach yell, “Get locked in!” from the dugout. It was in an angry tone too, like when your mom catches you with a snack before dinner.

The next pitch was hit over the fence and still may not have landed. I’ve been to many baseball games, but I have never seen or heard a ball hit that perfectly again. Unfortunately, his pro career was short, but I wonder if he would even have had the chance if he didn’t have a good coach keeping him locked in.

The next pitch was hit over the fence and still may not have landed. I’ve been to many baseball games, but I have never seen or heard a ball hit that perfectly again. Unfortunately, his pro career was short, but I wonder if he would even have had the chance if he didn’t have a good coach keeping him locked in.

Focus in financial planning: Conclusion

There are a lot of references to money in the Bible. I have written on many of them, but there is one story that jumps in my mind when discussing focus. It has nothing to do with money, but it fits here.

First, I think it’s important to note that when reading the Bible, we’re looking back at the stories while the characters were living the stories. For example, it’s easy for us to ridicule the rich young ruler, but try putting yourself in his sandals. We are 100% certain Jesus is our Lord and Savior, but how certain was this guy? Read Mark 10:17-27.

Jesus hadn’t been crucified or risen from the dead yet, so I can see how the guy had doubt. I didn’t say I agreed with him, but I understand his thoughts.

Another time where it’s easy to criticize is when Peter walked on water. Read Matthew 14:22-33.

When his eyes were on Jesus, he walked on water with no problem at all. However, when he took his focus off of Jesus, he started to sink. Again, it’s easy for us to criticize, but Peter may not have been 100% certain of Jesus yet.

We can say all Peter needed to do was stay focused on Jesus, but I imagine doing the impossible was pretty distracting. There were no lifeguards to give CPR, nor was there a Coast Guard patrolling the seas. In Peter’s time, falling off the boat was almost certain death, but there he was walking on water toward Jesus. If Peter had social media, I’m sure he would be posting that moment everywhere!

No, I am not comparing financial planning to following Jesus, but I share that story to make us think about how our focus changes in our daily lives. Personally, I have been trying to write this blog for two weeks. Yes, some of the delay was because of obligations, but most of it was because I just didn’t sit at the computer and focus on typing.

For some things it doesn’t matter if we wait for the next day. Unfortunately, financial planning is not one of those things. For every day we wait, we can lose future value. By planning early, we can save smaller amounts while pursuing our goals. Waiting can force you to save more at a time or even change your future goals.

Regardless of how busy you are today, there needs to be some focus on your financial plan for the future. Fortunately, I can help ease that burden for you. Email me and let’s get to work!