Capitalism in America

I recently read Capitalism in America: A History, by Alan Greenspan and Adrian Wooldbridge.

Like all history books, it can be a little long, but it’s very interesting. I always had trouble with books like this in school because there is so much information. I love to learn, but what I found interesting was never what the teacher thought should be included on the exams. Even in college, I would do bad on the first exam and spend the entire semester digging myself out of a hole.

It wasn’t that I didn’t understand the material, it just took some time to get on the same page as the professor. It was frustrating, but I was able to get through and now I can read purely for pleasure. I would probably still struggle with an exam on this book, but I learned a lot from Capitalism in America.

It wasn’t that I didn’t understand the material, it just took some time to get on the same page as the professor. It was frustrating, but I was able to get through and now I can read purely for pleasure. I would probably still struggle with an exam on this book, but I learned a lot from Capitalism in America.

The book describes the different changes in the economy throughout the life of the United States. Of course, everyone knows we started in agriculture, then had the Industrial Revolution, and are now a service economy. Greenspan and Wooldbridge take us deeper in our American story. I definitely recommend the book. Of course, I think we moved into an entertainment economy as noted here and here.

Capitalism in America: The Federal Reserve

I purchased the book because of Alan Greenspan. I admire anyone who is the Chairmen of the Federal Reserve, but Greenspan was in the position when I first started having interest in finance and economics. He became a role model as I was amazed by his intelligence. His answers during interviews gave simple explanations anyone could understand. Plus, he has that grandpa aura where you just want to sit and listen to his stories.

The Federal Reserve has been receiving more attention over the past year or so because they are our main weapon in the fight against inflation. Some say the President of the United States is the most powerful person in the world, but I would argue that the Chairman of the Federal Reserve has the real power.

main weapon in the fight against inflation. Some say the President of the United States is the most powerful person in the world, but I would argue that the Chairman of the Federal Reserve has the real power.

While I will always admire anyone in that position, there isn’t enough money in the world for me to take that job. Talk about pressure! The Federal Reserve is an independent agency, which means politicians cannot influence decisions. I love that part, but it must be hard knowing half of the people will hate you regardless of your decision. After all, the members of the Federal Reserve are people with feelings, not robots.

Although they are independent, the Fed still has to report to Congress.

The Chairman of the Federal Reserve, currently Jerome Powell, has to “testify” before both the House and Senate a few times throughout the year. A fun fact is that the testimony has to be exactly the same word for word to the House and Senate. I think they could save time and money by emailing a PDF copy to all politicians, then do one day of questions, but they didn’t ask my opinion.

The Chairman’s testimony is carried live on CNBC and the investing community hangs on every word. When the Chairman speaks, the market can move, so investors try to position their portfolios in accordance to the Chairman’s economic plan. Of course, a fiduciary should focus on their clients’ long term plans and not just one day, but it is still fun to watch.

After the Fed Chairman reads his statement, then the politicians ask questions and the real fun begins.

Each person gets about five minutes to discuss things with the Chairman. The exchange normally starts with the standard professional “Thank you for giving me my time, Foreperson” and “Thank you for your service, Mr. Chairman.” Then the politicians ask a legitimate question, but you can almost guarantee this time will turn into a political platform where they send barbs at their “colleagues across the aisle.”

To make it even more entertaining, they alternate the question times between a Democrat and Republican. They politely bicker back and forth while the Chairman of the Federal Reserve sits in the hot seat. It reminds me of when the parents of a child athlete make participation all about themselves and not the child.

To make it even more entertaining, they alternate the question times between a Democrat and Republican. They politely bicker back and forth while the Chairman of the Federal Reserve sits in the hot seat. It reminds me of when the parents of a child athlete make participation all about themselves and not the child.

Ben Bernanke was my favorite Fed Chairman to watch because he always said something like, “That would require a change in fiscal policy where we only handle monetary policy.” The Federal Reserve has a dual mandate that requires them to focus on price stability and maximum employment. We call this monetary policy and we have seen how the country and even the world can struggle when that equilibrium is messed up.

Politicians, on the other hand, are in charge of fiscal policy. This would include raising or lowering the taxes we pay. Basically, Bernanke was saying to the politicians, “That’s your job and not mine.” It was priceless!

Capitalism in America: Warren questioning Powell about the unemployment numbers.

Recently, Senator Elizabeth Warren attacked current Chairman, Jerome Powell, during his testimony. He handled it well, but I think she went too far.

Powell had stated that unemployment should increase during the war with inflation. That makes sense because increasing interest rates can make it harder for bosses to get money needed for payroll, so they may have to cut that expense by eliminating jobs. Warren, in a classic political tactic, seemed to place all of the blame on Chairman Powell.

She calculated that increasing the unemployment rate would cause two million people to lose their jobs. She then asked Powell what he would say to those people. Powell said he would say that the other 300 million American citizens and the world are all suffering with inflation right now.

Unfortunately, that wasn’t good enough and Senator Warren continued to interrupt Powell saying he didn’t care about those people. She even went so far as to say someone else needs to be in his position. I’m sure you can find the exchange online, but I don’t want to watch it again. It’s just sad.

Please understand, I know how hard it is to lose a job. My dad lost his job while I was in high school and my first job was basically eliminated. I also have many friends who have faced periods of unemployment. It’s not easy, but we all persevered.

Capitalism in America: The greatest asset America has had and will ever have is the undying spirit of the American worker.

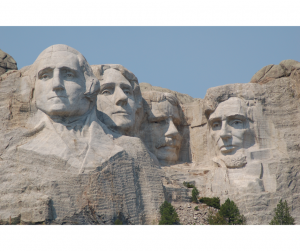

We don’t give up. We have God given dreams in our hearts and the God given talent to makes those dreams a reality. Our spirit didn’t die in the Revolution, the War of 1812, the Civil War, World War I, the Great Depression, World War II, September 11, or the Financial Crisis of 2008.

There are other past examples and will be new ones in the future. My point is that every time we face challenges as a country, we endure and come out stronger. Sure, we have had good leadership, but the drive of the American worker has always been the force behind our success.

challenges as a country, we endure and come out stronger. Sure, we have had good leadership, but the drive of the American worker has always been the force behind our success.

Heroes are never made by blaming others. They are forged in the trials of life. When they endure those trials, they emerge as an unstoppable force. That force is the American Spirit and you don’t want to bet against it!

When soldiers came back from World War II, they brought many new skills with them.

My grandfather, a farmer from Clinton, North Carolina, was on a destroyer. He had to learn the workings of his boat, which allowed him to bring back mechanical and problem solving skills that he may not have had before.

Furthermore, women moved into the workplace while the male employees were at war. The women didn’t want to leave their jobs after the war and management was smart enough to know the value of human capital. Businesses adjusted to these new employee resources and America experienced one of the largest economic booms in the history of the world.

Could we be heading for another economic shift like that? No one can know for certain. One thing I do know is that if you want to succeed in capitalism, you must be willing to adapt. Maybe if politicians, like Senator Warren, would read Capitalism in America: A History then they would be a little more understanding.

It’s hard for entrepreneurs to chase dreams and create jobs for the community when there are so many roadblocks.

Greenspan discusses the stagnation of our economy in the book and lists political pressures as one of the causes. So many of America’s giant businesses were started by one person tinkering in their garage. That’s difficult now because everyone can’t afford the team of lawyers needed to get them through all of the paperwork.

Dreams die when they’re too difficult. I know I almost gave up on mine because there was a restriction with every step forward. I cannot accept just living the rest of my days taking my disability check and watching television. No American should. We aren’t built for that!

Yes, Chairmen Powell could continue raising rates and an increase in unemployment can be the result. However, those people who lose their jobs can be a great fit for other jobs. Maybe someone who was downsized at Facebook could lead the next technological revolution.

The factory workers of the 1940’s would be amazed at the jobs of today. Imagine if the lawmakers then only focused on the negative. The American economic machine may have never started!

Opportunity cost is when we analyze the potential gain versus the potential cost.

In economics, as in many other areas of life, every action has a reaction. All things being equal, if 2 million people have to face a career change in order to help the lives of billions around the world, then I would consider that an acceptable action.

Instead of attacking and blaming Chairman Powell, politicians could work on the Federal Job Guarantee promoted by Modern Monetary Theory. Perhaps they could provide more educational resources to train those looking for a new career. How about helping with healthcare costs for EVERYONE?

What does this all mean for your financial plan?

I always start with hope. We’re going to have some difficult days ahead, but sticking to your long term goals is normally the best idea. Discipline through tough times is a major step in making dreams become a reality. Email me!

I always start with hope. We’re going to have some difficult days ahead, but sticking to your long term goals is normally the best idea. Discipline through tough times is a major step in making dreams become a reality. Email me!