Are you making the maximum contribution to your retirement plan? More often than not, when I talk to prospective clients, the resistance people give me sounds something like this. “Jonathan, I already make the maximum contribution to my retirement plan at work, so there’s nothing else I can do.”

Normally, I accept the subtle rejection from the person and let them be on their way. I don’t want to start the relationship by calling them a liar. After all, they may really believe that they are making the maximum contribution. Unfortunately, they are often misinformed.

I have found that “maximum contribution” and even “401(k)” have become blanket terms we use when discussing job benefits with our peers. Unfortunately, this can be dangerous when building your financial plan. There are many different retirement plans and they all have their own rules, including different maximum contribution limits.

What is the maximum contribution for a 401(k) plan?

By far the most popular retirement plan is the 401(k) plan. Most large corporations use these, so they are normally what we hear about in casual conversations. A fun fact is that they’re named “401(k) plans” after the section where their rules are written in the Internal Revenue Code. Real creative, right?

“401(k) plans” after the section where their rules are written in the Internal Revenue Code. Real creative, right?

According to an IRS press release from October 11, 2022, the contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan is increased to $22,500 for 2023, up from $20,500. That’s much more than the 3% many of us contribute. Somehow, over the years, we started believing that “maximum contribution” meant the maximum amount matched by our employer. Unfortunately, that really should be considered the minimum contribution.

The 401(k) is just the beginning. Let’s look at some of the other retirement plan choices available to us. I’ll try to keep it brief and entertaining, but this is important information.

What is the maximum contribution for a SIMPLE IRA plan?

Most of the small businesses in my area use what is called a SIMPLE IRA. You can guess by the name that a SIMPLE is pretty easy to set up. For the curious ones, like me, it stands for Savings Incentive Match PLan for Employees. All of the rules for the SIMPLE can be found on the IRS Website here, but the maximum contribution for people under the age of 50 in 2023 is $15,500.

As with the 401(k), employers can contribute to your SIMPLE plan as well. There are rules for them, so I strongly encourage you to talk to your employer. Some may match your contribution and other employers may just make contributions whether or not you contribute.

By not enrolling in these plans you can be leaving free money on the table. Most of us can’t afford to give up free money. I doubt many of us would purposely avoid this opportunity.

It may not sound like much when your employer contributes two percent, but it adds up. Two percent of $35,000 is $700. Multiply that by 20 years and your employer has given you $14,000 just for signing up! Who knows what that account balance could be if it was invested for 20 years. Signing up would be a no brainer for me!

What is the maximum contribution for a SEP IRA plan?

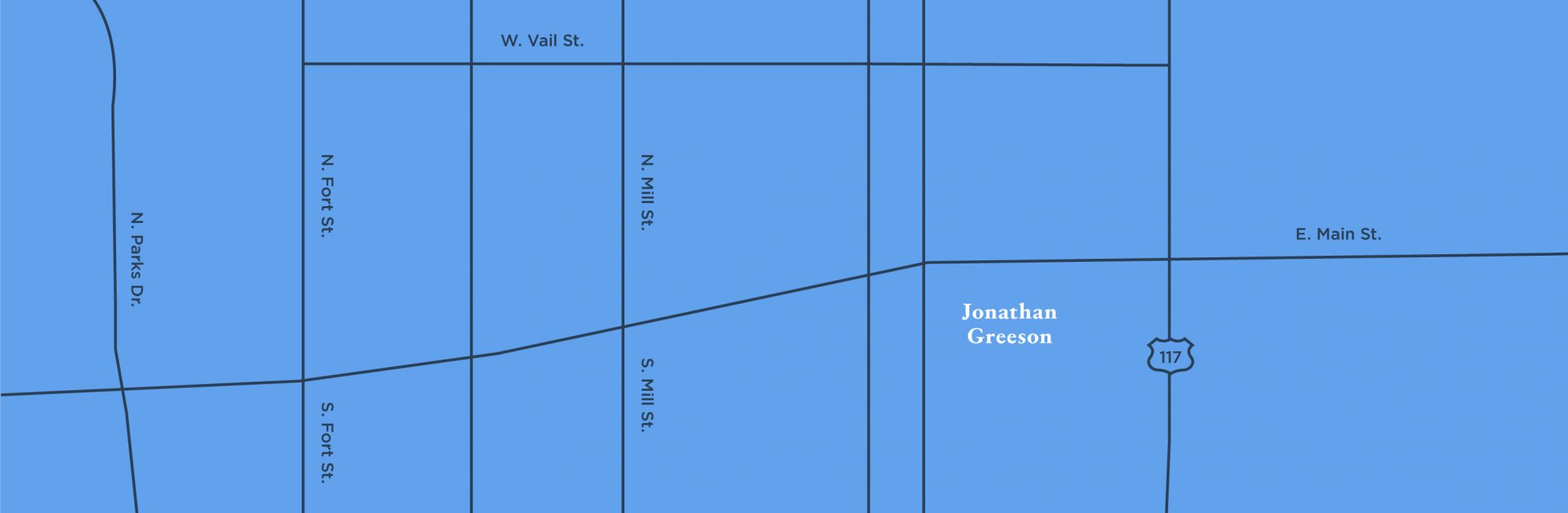

My community is rural. What I’ve found is that most families are dual income with an interesting wrinkle. Typically, one person works with a large company or with the state, so they receive health insurance and other benefits for the whole family. The other person is self-employed while on their spouse’s health plan, so they don’t have to worry as much about buying health insurance.

It creates an interesting dynamic in the family as co-CEOs of the home. Marriage is a partnership. When both parties are equal partners and on the same page I believe families are more likely to be successful and stay together.

It creates an interesting dynamic in the family as co-CEOs of the home. Marriage is a partnership. When both parties are equal partners and on the same page I believe families are more likely to be successful and stay together.

The only downside in this situation is that the self-employed person misses the opportunity for retirement savings. Fortunately, their friendly neighborhood financial planner, A.K.A. me, can help with that!

The Simplified Employee Pension Plan, or SEP, is my favorite to set up for my self-employed clients. It’s really easy to set up, lowers your current taxable income, and has a high limit.

To me, the best thing about a SEP is that you can vary your contributions. You don’t even have to contribute if you had a down year. If you have an amazing year, contribute more and lower your current tax bill.

There are some stipulations for self-employed individuals, so be sure to consult your tax advisor before contributing to your SEP IRA. The basics for the maximum contribution to a SEP IRA in 2023 is the smaller of 25% of income or $66,000.

What is the maximum contribution for a Traditional or Roth IRA?

Of course, we cannot forget about the wonderful traditional IRA and the Roth IRA. While these are different, the maximum contributions are the same. For 2023, a person under 50 years of age can normally contribute $6,500. There are some stipulations and catch up contributions for people over 50, but that’s beyond the scope of this post.

I think these personal IRA’s are an important piece of the financial plan. When we realize Social Security and our work retirement plans won’t be enough to meet our needs, the personal IRA can help fill the gap. Of course, it can’t help us in the future if we don’t start contributing to it today.

Taxes must be considered in retirement just like they are today. Taxes are the main difference between the traditional and Roth IRA. The traditional IRA can give you a tax break now by reducing your current taxable income. However, you will be taxed on distributions from the account during retirement.

On the other hand, the Roth IRA is not taxable in retirement. However, you do not receive a tax break now. As we all know, the government will get their piece one way or another. It’s up to you to decide when that happens.

My favorite thing about financial planning is that everyone’s plan is different. Sure, the framework is similar, but the plan changes for each family. We all have different goals in our lives, so we should all have different plans for our money.

Remember, money is a tool and nothing more. What we build with that tool depends on your vision and your commitment to making that vision a reality. And, of course, a financial planner to keep you on track.

Conclusion.

I tell clients that my job is to help them find the balance between enjoying today and preparing for tomorrow. Some clients prefer to live life to the fullest today and just get by tomorrow, saving little for the future. Others prefer to just get by today, save more for tomorrow, and live life to the fullest in the future.

Neither choice is wrong. Each client is doing what they believe is right for their family. However, there are consequences to each choice that the client must accept.

Financial planning can be scary because you have to do some soul searching. Spouses have to look each other in the eye and decide if they’re ready to build a life together or if they’re just playing house. Yes, that sounds harsh, but it’s true.

The decisions you make today can absolutely impact your life tomorrow. We’re always told to surround ourselves with the right people, don’t do drugs, and to eat healthy. I would argue that financial planning should be added to the list of those “Keys to a good life.”

When we don’t prepare for tomorrow, we’re accepting the fact that someone else will have to take care of us. Our parents won’t be there to bail us out when we reach our golden years. In fact, many of us may be taking care of our aging parents.

When our resources are limited, I think it’s important to maximize those resources. Sometimes that means we must capitalize on the opportunities available to us. This could be as easy as participating your company’s SIMPLE IRA plan or by lowering your taxable income by opening an IRA.

We’ll never know what we can accomplish until we try. Email me.