Social Security is one of the most important expenses paid by our government. I’m sure Elon Musk and his Department of Government Efficiency have Social Security on their chopping block, which may be a good thing.

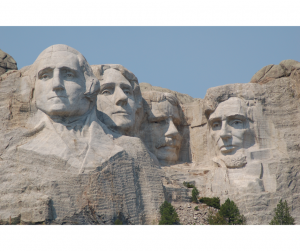

Unfortunately, when our government attempts to tackle big issues, they seem to screw them up instead of making them better. Then, their opponents use these “failures” in their next election campaigns. This is nothing new. Even George Washington had to endure smear campaigns before being elected to a second term.

election campaigns. This is nothing new. Even George Washington had to endure smear campaigns before being elected to a second term.

It’s sad that we still have a hard time working together to solve our problems after almost 250 years. Sure, we have done amazing things in our country. However, I think that is more because of the American citizens, not the politicians.

Unfortunately, we must pay attention to politics because their decisions can have an impact on our financial plans.

The Department of Government Efficiency provided a perfect example of why we all need financial planning. Watching those people leaving their office with boxes of personal items should remind us that unemployment can happen to any of us at any time. Financial plans help us prepare for, and endure, life’s challenges.

In their arrogance, politicians present themselves as heroes who will fix our problems, but they won’t. Sorry to be so blunt, but it’s true. Once we understand and accept this reality, we can begin pursuing our American dreams.

It is virtually impossible to realize our American dreams without financial planning.

Dreams are great, but our real power as American citizens comes with financial independence. That looks different for everyone because we all have different desires, but financial independence should be the goal of every American.

No, that doesn’t mean we all need the obscene amount of wealth enjoyed by people like Elon Musk. However, we should strive to reach a level where we don’t have to rely on anyone for our financial well-being. Trust me, being a slave to the system is no way to live.

We can assume that Social Security has been politically weaponized since its inception in 1935.

One of the first steps to solving the Social Security problem is to stop pushing the lie that the program will run out of money. The American people put money into the “Social Security Trust Fund” each year.

Although it is promoted as a tax, this money should be considered more like a contribution to our retirement fund. No, it is not enough to cover our retirement needs, but its purpose is to aid us in retirement or when facing a disability.

Although it is promoted as a tax, this money should be considered more like a contribution to our retirement fund. No, it is not enough to cover our retirement needs, but its purpose is to aid us in retirement or when facing a disability.

Knowing this, it would be political suicide for any lawmaker to cancel Social Security. It won’t happen. Regardless of what they say, a politician’s priority is themselves. They are not going to jeopardize their chances at reelection.

If there is real concern about Social Security running out, the solution would be to ELIMINATE restrictions, not cutting the program or decreasing the benefits.

That starts by eliminating the max amount of our salary on which Social Security taxes are paid. These taxes are deducted from our paycheck labeled as FICA or OASDI. There are actually limits to how much of our salary can be taxed for Social Security.

For 2025, Social Security taxes are only deducted from the first $176,100 of your salary. For most of us in the middle class, it is unlikely that we will ever reach that threshold. However, the limits create a nice tax break for the wealthy.

Getting rid of the tax limit would raise revenue for Social Security without adding more taxes on the middle class. Isn’t helping the middle class the message we always hear during political campaigns?

I think taking steps to secure retirement resources without increasing our taxes is pretty helpful. Social Security can account for about a third of our retirement resources. I think we would all appreciate that resource being protected.

Politicians claim to want the wealthy to pay their fair share.

Wealthy donors contribute billions of dollars, so commercials can bombard us with messages of how voting for certain candidates will protect the middle class. If they really supported these politicians, wouldn’t they happily pay taxes?

politicians, wouldn’t they happily pay taxes?

I think the wealthy would gladly contribute more Social Security taxes. People enjoy helping their fellow citizens. As we know, most wealthy people donate their fortunes to nonprofits, helping causes they believe in, while avoiding paying taxes.

Shouldn’t that be a red flag for everyone? Perhaps wealthy people aren’t the problem. Maybe they trust nonprofit organizations to help the American people more than they trust our political leaders.

I don’t blame them. I gladly give to my church each month. It’s not much, but I know the money is being put to good use. It’s hard to trust where our taxes are going.

Yes, there are cases of fraud where bad apples take advantage of the Social Security system.

Of course, these stories get the attention of Elon Musk and the Department of Government Efficiency. The majority of the fraud occurring in the system is caused by the businesses that bill the system, such as doctors’ offices and healthcare facilities.

Fraud rarely results from benefits paid to the American citizens. However, those of us receiving disability payments are the ones getting harassed. Recently I had to send Social Security $375 because, apparently, I was overpaid from 2023-2025. I have a hard time believing much fraud exists in a system that fixed their mistake of overpaying me $15 a month for two years.

Furthermore, fraud occurring in the healthcare system comes mostly from Medicare funds, which is a completely different tax from Social Security. Also, retirees on Medicare pay a premium like any other person buying health insurance. That premium is usually deducted from their Social Security check.

It should also be noted that the Medicare tax also has no income limit, so the wealthy do not get a break.

By eliminating the taxable income limit, the wealthy pay their fair share on a tax that DIRECTLY HELPS THEIR FELLOW AMERICANS, and we increase the revenue going into the “Social Security Trust Fund” without increasing the burden on the middle class. Both parties should be happy with that, right?

We should also eliminate the earning limits for Social Security beneficiaries!

This one hits me personally and frustrates me to no end! Again, yes there have been bad apples who have taken advantage of the system. They should not represent all beneficiaries.

I live in a rural community, my dad worked in agriculture, and I was even FFA President in high school. Over the years I have learned some things about farming. When there is a problem with a crop, you treat the issue and protect the rest of the crop. No farmer in their right mind would burn down their whole orchard because of a few rotten apples.

By placing earning limits on people with disabilities our politicians are in effect doing what a rational farmer (or any other rational human being) would never do. Sure, politicians have a lot going on, so I don’t think they are purposely crippling people with disabilities. At least I hope that is true and will give them the benefit of the doubt for my own sanity.

By placing earning limits on people with disabilities our politicians are in effect doing what a rational farmer (or any other rational human being) would never do. Sure, politicians have a lot going on, so I don’t think they are purposely crippling people with disabilities. At least I hope that is true and will give them the benefit of the doubt for my own sanity.

As with the argument above, there are only positive results from eliminating this limit. Allowing people with disabilities to have unlimited earning potential would result in increased revenue from income taxes AND Social Security taxes. I cannot imagine anyone having an issue with that.

Asking for more help for people with disabilities would probably be unproductive as healthcare costs is a problem for all Americans.

It has been well established that the daily cost of living increases when someone has a disability. Obviously, medical devices, such as wheelchairs, get headlines and are covered by insurance. However, we should look at basic expenses as well.

Consider a roll of toilet paper. An able-bodied person pays for the roll and that’s it. A person with a disability must pay for the roll, then pay a person to help them use the bathroom. There are many other items to add to that list.

Now, I don’t know any rational American who would see a problem with me keeping the meager assistance I receive from Social Security, Medicare, and Medicaid while I earn as much income as possible.

possible.

As I pursue independence, the unalienable right promised to all Americans, I will also be providing more tax revenue to the government WITHOUT increasing the costs of my benefits paid. A quick executive order eliminating limits could fix Social Security easily.

People with disabilities have the highest rate of unemployment among the demographics measured. I’m pretty sure these antiquated limits are the main reason. Not all of us can work, but those who can work should be allowed to try.

Technology has created access to jobs for us. We worked from home before it was cool. The politicians need to catch up with us and just get out of our way!