We can all agree that social media has become the Wild West of the internet. For those of you who have never seen a Western movie, imagine cowboys playing cards in a bar. Suddenly, one calls the other a cheater, then the table flips over and they all start shooting each other. Thanks to my friends, Genna and Michael, for letting me use their picture as a cool visual for this blog

Today’s Wild West is on social media, not the OK Corral.

Don’t believe me? Have a slightly controversial opinion on Twitter and see how many strangers take their “shots” at you via comments. It can get pretty scary and, most of the time, it’s just better to move on. It is hard to convince someone of your opinion when they’re already hoping for a fight. When people are pulling in opposite directions, nobody gets anywhere. Just ask a politician!

Sometimes, as a fiduciary, I do feel it is my duty to speak up because I would hate to see my clients base their future plans on a social media post. The compliance people monitor all of my posts for that very reason. If I post anything that can be interpreted as specific investment advice, I get a nice little email telling me to delete it. Unfortunately, the rest of the world isn’t regulated like this.

Any person can post a “hot stock tip” on social media.

You must use your own judgement as to whether or not it’s a smart investment for you. Yes, I love the stock market and encourage everyone to learn and invest. However, there is a difference in how you invest in a small brokerage account for fun and how I have to invest your retirement funds.

If you lose in a brokerage account, you learn a lesson. That was extra “mad money” anyway, right? If you lose everything in your retirement fund, then that can be life altering! It’s not always about having more resources or the highest performance. The focus on a retirement fund is to give you the best chance to reach your goals. A portfolio manager should be more interested in what you may have 30 years from now and not worry so much about what the market did today.

Investing Yourself vs. Social Security. The debate continues on social media.

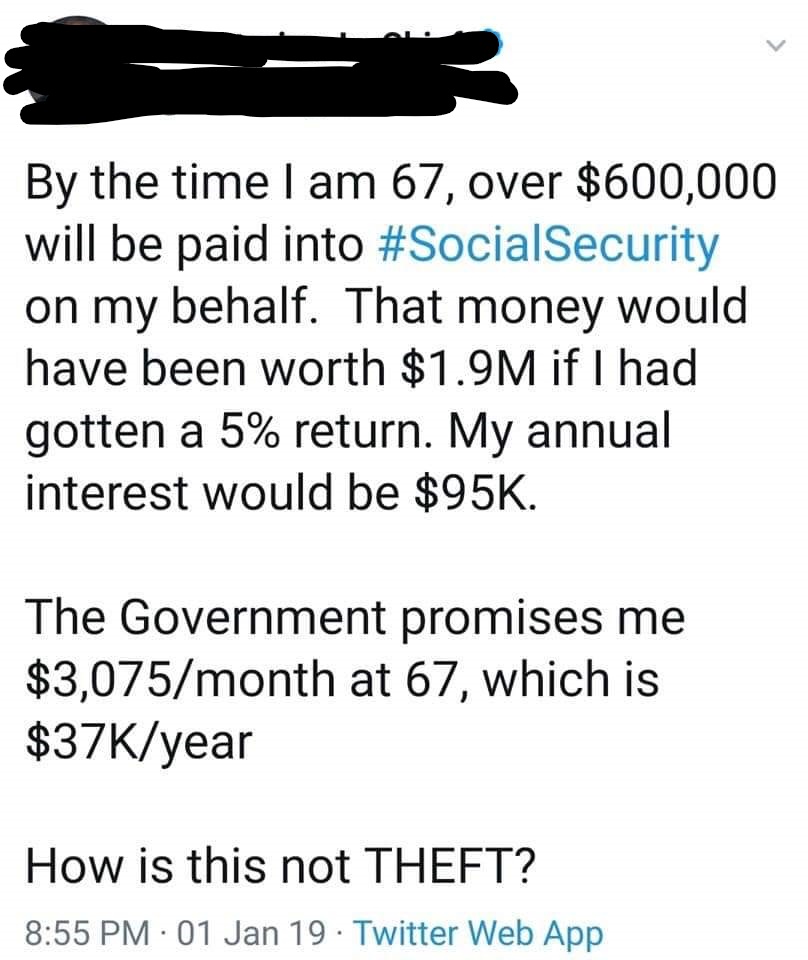

Recently, I saw a post about Social Security and how we could invest that money ourselves and possibly get more than the Government has promised. This is not the first time I have seen this posted as I usually just move on, but I think it’s time for me to tear this one apart because it can be dangerous for our retirement plans.

The Tweet says:

By the time I am 67, over $600,000 will be paid into Social Security on my behalf. That money would have been worth $1.9 million if I had gotten a 5% return. My annual interest would be $95,000. The government promises me $3,075 per month at 67, which is $37,000 per year. How is this not theft?

Politics aside, let’s talk about the numbers. The quoted numbers may well be accurate, but there are a lot assumptions taken out of this statement.

Social Security is a very important starting point when we talk about retirement planning. As a planner, I love knowing that my clients will have that promised income. No, it’s not enough, but it was never intended to be. When I’m developing a plan, I need to estimate the monthly needs of a client. For example, if they need $5,000 a month and are promised $2,000 a month in Social Security, then I only need to find an additional $3,000 a month to cover their needs. This extra money is found in IRAs and other savings accounts, which is why it’s so important to start saving now.

It’s easy to say that we as individuals could have done better by investing our own money, but actions speak louder than words.

Over half of Americans don’t have $500 saved for an emergency, so do we really believe that we can trust ourselves to put 6.2% of our income in a retirement account each month? (That’s what the Social Security tax is by the way. Actually, it’s 12.4%, but your employer pays half of it for you.)

Before you say yes, remember this saving requirement would be in addition to any contributions to your 401(k) or other retirement accounts. Many people don’t even meet the employer match on these accounts, so they’re basically not accepting free money. Your employer is saying that if you put 3% in this retirement account, they will put an additional 3% in the account for you. If 3% is too much to save, even with the incentive of the contribution being doubled, then do we honestly believe we can put 6.2% more away on our own?

It’s easy to say you can on Social Media, but we all know the real world is different.

We live in the real world where there is no way we can guarantee a 5% return on an investment. Sure, over time, you may get the 5% return or even more, but you can also lose it all. Throughout history, the stock market has been one of the best ways to get a return on your money. In order to get a big reward, sometimes you must take a big risk. The anticipated high return investors are seeking is based on what we call a risk premium. Basically, an investor is willing to lose their money for a CHANCE at a higher return.

There is no guarantee. However, with Social Security there is a promise. I’m not comfortable in trusting politicians to follow through on their promises either, but it is a law. As I’ve said before, I don’t think any politician will risk their career by trying to repeal that law. They may amend it or change the name, but I’m comfortable including something like Social Security as a part of my clients’ financial plans.

Finally, let’s address the elephant in the room: the totals on the social media post.

The tweet suggested annual income of $95,000 compared to Social Security’s promise of $37,000. Big difference, right?

Remember the risk premium? The higher assumed income is an incentive to take the risks involved with investing. In order to get your Social Security, you just put in your time at a job and fill out some paperwork. There is very little risk involved in receiving it, so you can’t really justify a higher expected return with a risk premium.

Also, one of the most important points to consider is inflation. Social Security is indexed for inflation, which means your check can increase as your cost of living increases. That doesn’t happen with your investment accounts. Financial planners can do some math where we can estimate inflation and adjust your needs, but none of that is included by the tweet. For all we know, $95,000 could equal $37,000 in purchasing power by the time you need to live off of your retirement savings.

The tweet was originally posted in 2019, but I recently saw it posted on Facebook.

Over two years later, this incomplete message is still out there. We may not think it’s a problem and that it doesn’t influence our decisions, but it can. When statements like this are made, it can lead to a dangerous feeling of hopelessness. It’s easy to say to ourselves, “I could have $95,000, but I’m only getting $37,000. I’ll never have a better life, so why should I even try?” My fear is that you have the same nonsense running through your mind.

I’ve been there before. Being on Disability Assistance, there is always a thought in the back of my mind saying, “You’re not allowed to build resources without losing your benefits, so you’ll never be able to have a better life.” Of course, there is some truth to that statement, but it’s also complete crap!

The truth is that these feelings are exactly why we should try! I will always build my practice on hope. The hope that we can pursue our clearly defined, reasonable goals. When we’re able to reach our goals, not only do we feel better about ourselves, but we could also be living our God-given purpose.

Conclusion: The Battle Inside

I recently finished Craig Groeschel’s book, Winning the War in Your Mind: Change Your Thinking, Change Your Life.(Amazon Link). I have always heard of the internal battle we face between good and evil. The battle is even told in legends as two wolves fighting. One is white (for light and goodness) while the other is black (for darkness and evil). Which one wins? Well, it depends on which one you feed.

Groeschel goes a little further and says the negative thoughts in our mind are the lies of the Devil. That’s how Satan works, by trying to manipulate us through lies. He did the same when he tempted Jesus. Satan knew that Jesus came to save all of humanity, so he tried to get Jesus to stray from His Purpose.

No, we’re not the Savior of humanity, but God does have a purpose for all of us. It’s hard for us to hear that purpose when we let the Black Wolf howl too loudly. Unfortunately, we try to silence the bad feelings with spending money. We buy a new outfit that makes us feel better for about ten minutes. When that stops working, we move on to unhealthy habits like drugs, alcohol, overeating, etc.

While it seems okay because we’re not hurting anyone other than ourselves, these habits and expenses could be pushing us away from our purpose. What if you’re supposed to volunteer 30 years from now where you mentor a group of kids who end up curing cancer? It’s hard to volunteer when you don’t have financial independence because you didn’t save for retirement. When I think of my life with that perspective, I’m able to tell Satan to shut up with all of those negative lies. He’s always going to be there, but I don’t have to listen.

As we look at our social media, we must remember this choice as well. Unfortunately, the algorithms show you the information to which you pay attention. If you are pulled in by negative posts or articles, you will continue seeing similar things. The negative thoughts can use that as fuel to become louder in your minds.

Social media is a great tool. I love using it myself. However, please be careful that you don’t base your future on a single post. Do your own research and talk to a professional when you have questions or ideas. I’m here to help! Email me.

Jonathan Greeson and/or Jonathan Greeson Financial Planning are not affiliated with or endorsed by the Social Security Administration or any other government agency.

Registered Investment Advisors and Investment Advisor Representatives act as fiduciaries for all of our investment management clients. We have an obligation to act in the best interests of our clients and to make full disclosure of any conflicts of interests, if any exist. Please refer to our firm brochure, the ADV 2A page 4, for additional information.